|

Accelerated LPA and Legal Document Understanding

NEW YORK (PRWEB) July 14, 2021 -- We are pleased to announce a partnership with Claira LLC (www.claira.io), the leading next-gen AI company specializing in legal contract understanding. This partnership highlights Cascata Solutions’ continued commitment to innovation and further expands our leading automated waterfall and fee management platform for alternative asset investors, asset managers, and fund administrators. Using Claira’s advanced AI and data science technology, Cascata has further enhanced its proven data sourcing and system commissioning methodology. “With most of our clients having 100s to 1000s of funds under management of all complexity, leveraging Claira’s AI technology will minimize human intervention to analyze typically lengthy Limited Partner Agreements (LPAs) and side letters and thereby significantly improve implementation time by 70% or more when extracting deal economics and interpreting legal terms and conditions crucial to calculating and reporting fund performance and management fees,” said Chuck Dooley, Cascata CEO and Co-founder. “Working with Claira has been highly efficient,” Chuck further added, “without having to provide training data, clients will get the benefit of having all the relevant fund terms, key data elements, and economic details of the arrangement automatically captured on the Cascata platform.” Claira’s pre-trained algorithm enables firms to simply drag & drop LPAs onto the Cascata platform or point Claira to client’s contract repositories to immediately analyze and extract the relevant information. Claira turns the pertinent legal documents into data for Cascata to construct and provision all necessary waterfall models. Contact us to learn more about the Cascata and Claira partnership and how Cascata’s PE Suite Solution provides an end-to-end platform to automate the administration of primary and shadow private capital waterfall and fee management. About Cascata (www.cascata-solutions.com) Cascata Solutions is dedicated to delivering advanced digital cloud solutions for the private capital industry to serve institutional investors, asset managers and their partners including fund administrators, software providers and accounting/audit firms to modernize their back-office operation for distribution waterfall administration and more. Cascata Solutions is a privately held and funded company, headquartered in New York City. About Claira (www.claira.io) Claira is a leading next-gen AI company specializing in legal contract understanding. Built using advanced data science to reveal the underlying logic trapped in financial contracts, Claira is pre-trained to comprehend legal language — providing faster, deeper, and more actionable results with full transparency and traceability in its decision making. No training, setup, or installation required. Claira can be accessed from any web browser or locally installed in a client’s data center.

1 Comment

Excel-like flexibility to model the most complex carry arrangements for fund administrators and asset managers Cascata Solutions, the leader in automated Waterfall administration software and services for private equity, has expanded its Cascata PE Suite™ platform to allow users to model unique and most complex waterfall hurdles formalistically with greater flexibility and control. Waterfall model construction and distribution are some of the most complex tasks in the private equity back-office administration, as there are limited standards and many complexities and nuances, because of the wide range of arrangements, investment structures and specialized terms. With Cascata Solutions’ new conditional, user-defined rules engine, we make it easy and transparent to reflect complex, multi-tiered structured carried interest arrangements on our platform. Users can select from a variety of fields (both external inputs as well as system calculated) to create formulas and more sophisticated conditional ‘gates’ through the waterfall. Example of Conditional Hurdle For more information, please visit our web page.

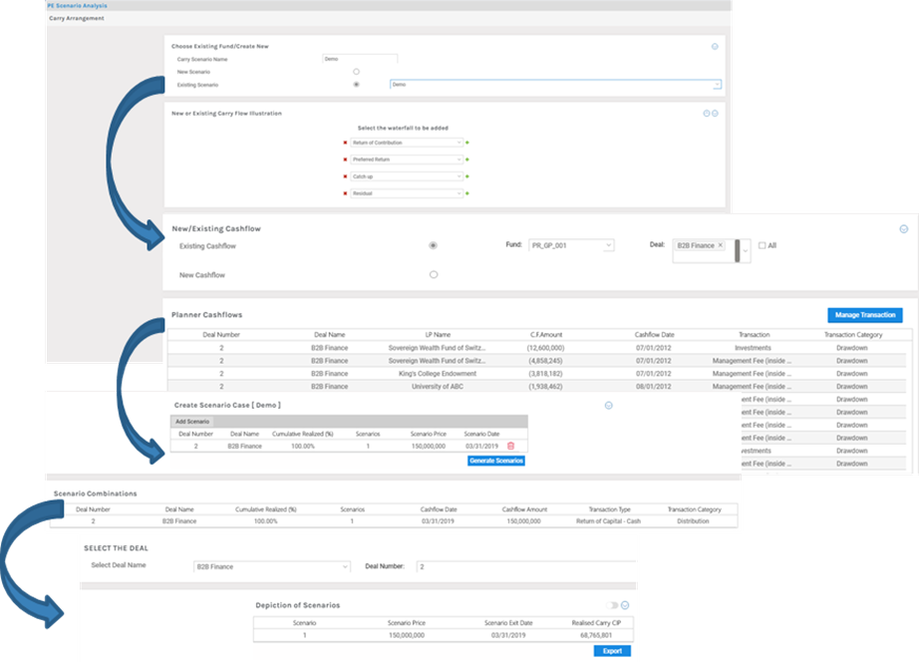

About Cascata Solutions Cascata Solutions is dedicated to delivering advanced digital cloud solutions for private capital asset managers and fund administrators to modernize their back-office operation for distribution waterfall administration and more. Cascata Solutions is a privately held and funded company, headquartered in New York City. Visit us at www.cascata-solutions.com.  Systematic and Predictive Insights for Optimized Fund Performance Cascata Solutions, the leader in automated Waterfall administration software and services for private equity, has released a new module to its software suite that delivers hypothetical carried interest modeling and scenario analytics for greater deal-level insights and return on investments for fund managers and administrators. Waterfall model construction and distribution are some of the most complex tasks in the private equity back office administration, as there are limited standards and many complexities and nuances, because of the wide range of arrangements, investment structures and specialized terms. “Carried interest is the ultimate reward for a job well done by a GP and yet most still rely on manual and bespoke processes, ad-hoc tools, e.g. Excel and key personnel making it operationally inefficient and prone to error that often results in misallocation of profits. Through the life cycle of the fund, from fundraising through the ongoing operation and exit, being able to forecast the most optimal outcome at an investment level is crucial to making these decisions and to achieve the greatest performance” said Chuck Dooley, Cascata Solutions CEO. Cascata Solutions’ new ‘Hypothetical’ Scenario Analytics Module provides the level of systematic predictability and insights through the life cycle of the fund to perform scenario forecasting based on user-definable and time-based parameters to evaluate the impact of hypothetical investment outcomes. For example:

With both use cases above, the system provides very powerful yet simple reporting capability for comparative analysis of the different outcomes for a particular investment-level transaction. For more information, please visit our web page. About Cascata Solutions Cascata Solutions is dedicated to delivering advanced digital cloud solutions for private capital asset managers and fund administrators to modernize their back-office operation for distribution waterfall administration and more. Cascata Solutions is a privately held and funded company, headquartered in New York City. Visit us at www.cascata-solutions.com. |

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

November 2023

Categories |

|

Cascata Solutions is dedicated to delivering advanced digital cloud solutions for private equity, asset managers and fund administrators to modernize their back office operation for distribution waterfall administration and more.

The founding team brings 30+ years of experience delivering technology and business transformation programs for leading financial services institutions and aims to replicate its success to help the private equity market redefine its operating model and create competitive advantage amid market uncertainty, increased competition and investor and regulatory scrutiny. |

CONTACT

99 Wall Street Suite 2501 New York, NY 10005 info@cascata-solutions.com Phone: (212) 355-4628 Toll Free: (800) 665-2816 |

|

© 2021 Cascata Solutions All rights reserved.

|